Please Note: I, personally, am not bound by a non-disclosure or gag clause. As such, I am at complete liberty to write about my opinions, my views and my experiences as they relate to a particular event.

Opinions, viewpoints and experiences are by definition ‘personal’. As such, @ZombifiedPixie asserts that her specific personal experience outlined in this blog may or may not be applicable to others.

Furthermore, whilst every effort is made to be honest and accurate, @ZombifiedPixie makes no claim that all details here are factual, representative or complete. Therefore, anyone researching any of the named parties are strongly advised to continue with his/her own research to form a more robust finding. To be blunt, this is an honest but opinionated diary and therefore should not be used in isolation when forming an opinion about any of the named parties.

For the avoidance of doubt, be advised that @ZombifiedPixie recounts the events below from the viewpoint of an observer and as an advisor to her husband. Succinctly, @ZombifiedPixie has NOT engaged in any contractual relationship with any of the named parties. In short and in the interest of clarity, @ZombifiedPixie has an outsider’s perspective. It is therefore up to the reader to make his/her own mind about the merits of this opinionated blog.

By continuing to read this post, you accept the terms of this website and you accept that you are reading an opinionated blog. @ZombifiedPixie accepts no liability if the reader mis-translates an opinion as a fact.

Feedback, correction and/or alternative viewpoints, please contact feedback@zombifiedpixie.com.

+ + + + + + + + +

Not wanting to be one-of-those-idiotic-overseas-buyers-who-buy-offplan-and-ends-up-buying-a-dump, I was very careful in selecting potential properties. An advantage that I have is that I know London very well after having lived there for 9+ years and could therefore quickly discount the bullshit in the glossy marketing materials. For example, “25 minutes from central London” is quite attractive on paper but is actually quite meaningless in reality. Why? Well, “central London” is not well defined and as such, it could mean 25 minutes from the the furthest point in Zone1 . . . and Zone1 is quite massive. Furthermore, the ’25 minutes’ claim is also ambiguous. A real Londoner would use the travel time published by Transport for London (TfL) to get a more accurate ‘guestimates’ rather than rely on the travel time published in the posh marketing. (That said, TfL times are actually ‘guestimates’ at best because the Underground is consistently unreliable.)

I also used Google to de-select and whittle down potential properties from my search list. Whilst extremely helpful, Google is no substitute for first-hand research. As such, a trip to London was mandatory before any serious money is exchanged.

As the property that we were interested in is a new-build and as the construction has not started yet, my goals in visiting London to assess this potential property at 325 Borough High Street (SE1) were:

(1) walk around the neighbourhood at multiple times during the day to assess the quality-of-life — i.e., traffic volume during the morning and evening rush hours; clubs/pubs/social places in the vicinity that could cause nuisance issues; volume of litter (if any) on the street; the personality of the neighbourhood, etc.

(2) view the vacant lot and “size” up the property. Floor plans are great but walking around the actual perimeter is a priceless assessment opportunity.

(3) view the developer’s past (completed) projects to assess the quality of the build and the quality of the fixtures and fittings. In addition, I wanted to interview nearby residents of the completed projects to get feedback on the construction crew. It is my opinion that a good developer hires a good construction crew. And, as such, this feedback would be a very valuable barometer in assessing the overall merit of this property purchase.

[ Reminder – please note #ZPDisclaimer. ]

Once the agent emailed me that the offer was accepted (subject to contract and with the reservation fee paid), I hopped onto a plane bound to London in Feb 2014 to conduct my own assessment.

In short, I recommended to my husband that this was a ‘good purchase’ based on the following factors: I assessed the neighbourhood and liked the area very much; the feedback from nearby businesses and tenants about the construction crew (from a recently completed project) was positive; the build quality of this completed project seemed to be of a high standard; I had personally met with the Heenal Lakhani, one of the directors of the property development company (‘Life Less Ordinary London Property Developers‘), and had a positive first impression; and finally, I did a Google-search on the company, the company directors, and their past credit histories — with no significant red flags raised. In short, I concluded that everything about this property appeared to be positive.

I was wrong.

Many months later and based on everything that I have observed (and in perfect hindsight), I look back at this trip with serious regrets. I regret wasting my time and my energy in assessing this property. More importantly, I regret advising my husband that based on my opinion he should pursue the purchase of this new-build apartment. And, I regret that we wasted many months of our time and our solicitor’s time reading thru countless documents and search-conveyancing results.

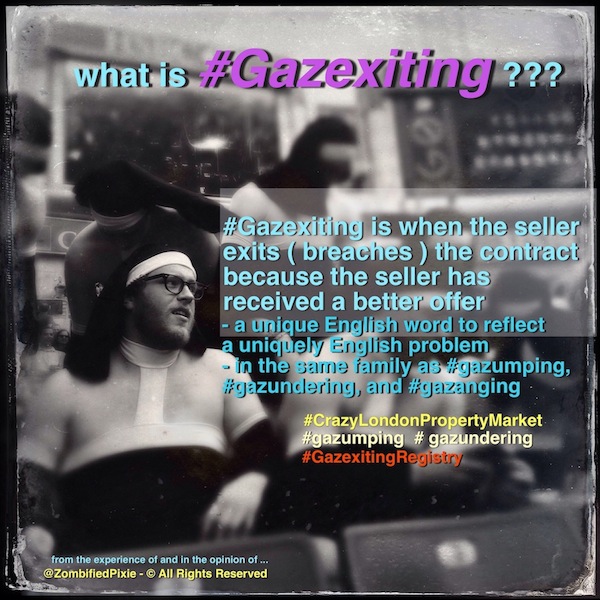

In hindsight, I’m not sure what more due diligence I could have done. The ‘curve ball’ that was thrown was completely unforeseen and in my opinion, more research would not have been helpful in uncovering it. Furthermore, our solicitor has advised that in his 20+ years of experience, he has never encountered this type of ‘curve ball’ before.

If there is a silver lining in this unpleasant event, then it is that we have purchased a better apartment elsewhere (but in the same neighbourhood). It is also a new-build and of the same quality specifications. More importantly, it is with a more established (and in my opinion, a more reputable) developer. Unfortunately, the replacement flat is more expensive (because the London property market dramatically increased during the many months we wasted with the original property and as a consequence, we were out-of-pocket financially with respect to the opportunity costs associated with a rising market).

Would I recommend ‘Life Less Ordinary London Property Developers‘ (www.l-l-o.com) to my family and friends? Based on my specific personal experience and based on what I have observed — No, absolutely not.